But Car Tax

10000 subtract Total vehicle sales price 25300 25300 x 7 state general rate 1771 1600 x 225 local sales tax 36 1600 x 275 Single Article tax. We would like to show you a description here but the site wont allow us.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

An additional 15 new vehicle county flat fee for cars.

But car tax. Where do drivers pay the highest age tax. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs. 825 in suburban Cook County.

A recent reminder V11 or last chance warning letter from DVLA your vehicle log book V5C -. 35000 Documentation fee. Beginning the second month following the due date interest accrues at75 percent per month until the taxes and fees are paid.

When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the vehicle into Illinois. In Illinois the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your assessors between October 1 and November 1.

HOW TO SAVE ON INSURANCE IN THE EVENT OF A CRASH. It accrues at a rate of 5 percent for the remainder of the month following the date in which the registration sticker expired. Check change of vehicle ownership status procedures replacement VRC incorrect sale date on VRC.

Baby Boomers reportedly have higher insurance costs. What if I purchase or lease a vehicle from an out-of-state dealer lending institution leasing company or other retailer. DMV will no longer accept paper tax releases beginning November 16 2015.

Vehicle Tax Subsidy Personal Property Relief Act 1998 PPTRA Under Virginia law the Commonwealth of Virginia subsidizes a percentage of the tax on the first 20000 of. The local property tax is computed and issued by your local tax collector. In case you were wondering heres what our state tax rates look like.

Pay Motor Tax track progress of my disc motor tax refund rates and forms. Declare your vehicle temporarily off the road over the internet. 725 outside of Cook County and Chicago.

TEMPORARILY OFF THE ROAD. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Car insurance age tax could impact two generations study finds.

For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation. If the sale is made by a motor vehicle dealer or lessor who is registered the sales tax rate is 625.

Tax your car motorcycle or other vehicle using a reference number from. Check if a vehicle is taxed Find out if a vehicle has up-to-date vehicle tax or has been registered as off the road SORN. Before you go car buying across state lines make sure you know how to pay the state sales tax properly so you do not end up with a tax evasion fine.

Your tax collector will need to clear you online. Car in Florida and paid 6 Florida sales tax. Purchase and Use Tax is due at the time of registration andor title at a percentage of the purchase price or the National Automobile Dealers Association NADA clean trade-in value whichever is greater minus the value of the trade-in vehicle or any other allowable credit.

95 in the city of Chicago. It can take up to 5 working days for the records to update. 11 hours agoCAR ACCIDENTS SPIKED NEARLY 8 IN 2020 SAYS DOT.

The use tax applies to all other types of transfers of title or possession where the vehicle transferred is stored used or consumed in Massachusetts. Interest is charged on late vehicle property tax payments and on late registration renewals. If you purchase a car out-of-state and bring it to your home state though it is not always clear which state should receive the tax since tax laws vary by state.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle purchase. Form RUT-50 Private Party Vehicle Use Tax Transaction Return. See Illinois residents pay sales tax based on where they register their car not where the vehicle is purchased.

300 Add Trade-in allowance. The list of vehicles that can get a Section 179 Tax Write-Off include. Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency exchange.

Baby Boomers and Gen Zers pay a higher and possibly unjustified average monthly car insurance premium in part because of supposed age tax according to a new study. You will pay it to your states DMV when you register the vehicle. If you need to obtain the forms prior to registering the vehicle send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302.

However you do not pay that tax to the car dealer or individual selling the car. In the US most states levy a sales tax when you buy a new vehicle. IStock Baby Boomers and Gen Zers pay a higher and possibly unjustified.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Electric Vehicle Tax Credits What You Need To Know Edmunds

Is Buying A Car Tax Deductible Lendingtree

Car Tax By State Usa Manual Car Sales Tax Calculator

Business Use Of Vehicles Turbotax Tax Tips Videos

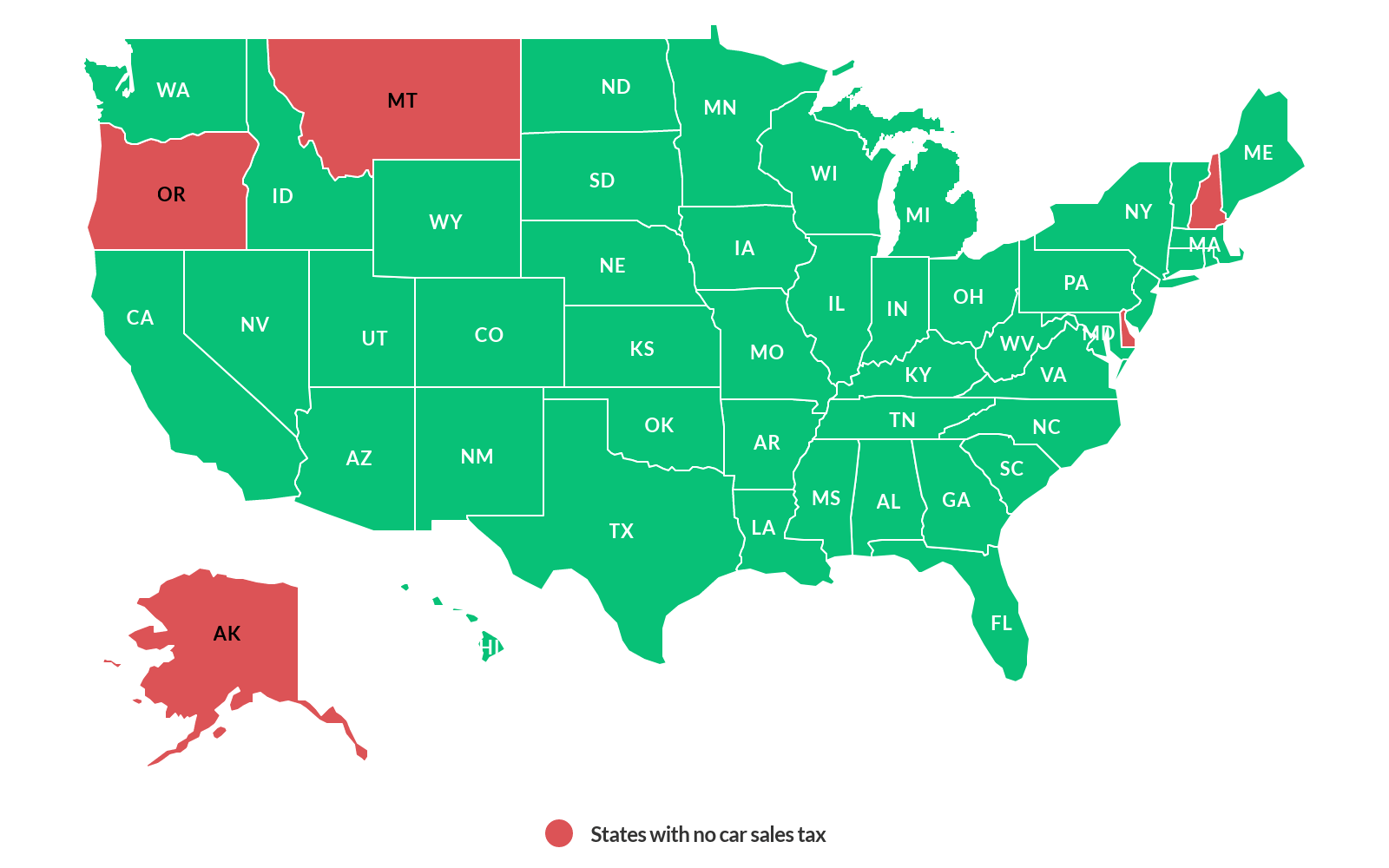

What S The Car Sales Tax In Each State Find The Best Car Price

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator