Utah Car Sales Tax

Click here for a larger sales tax map or here for a sales tax table. 89 rows This page lists the various sales use tax rates effective throughout Utah.

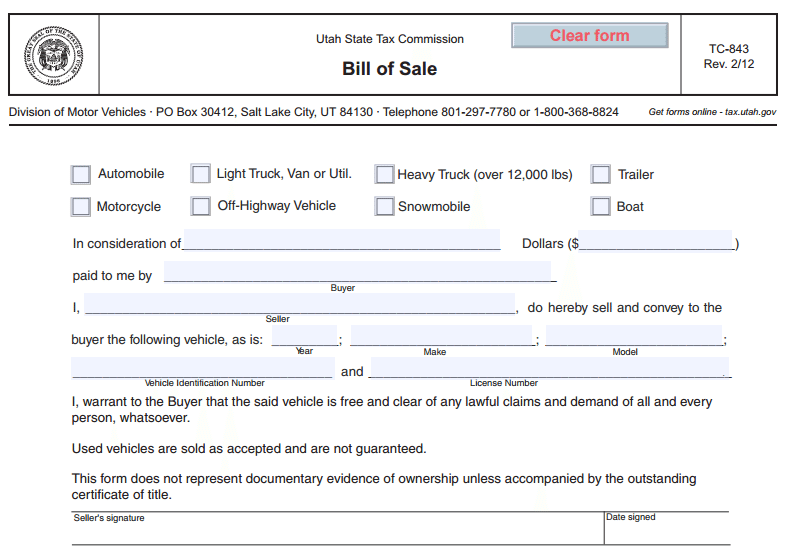

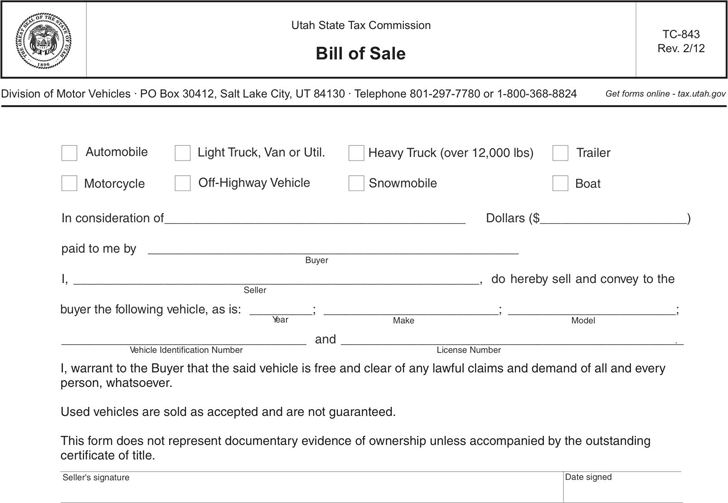

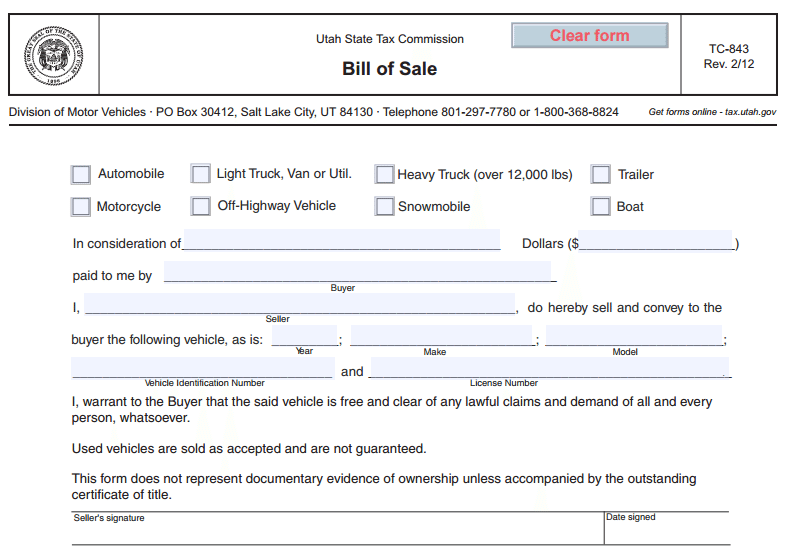

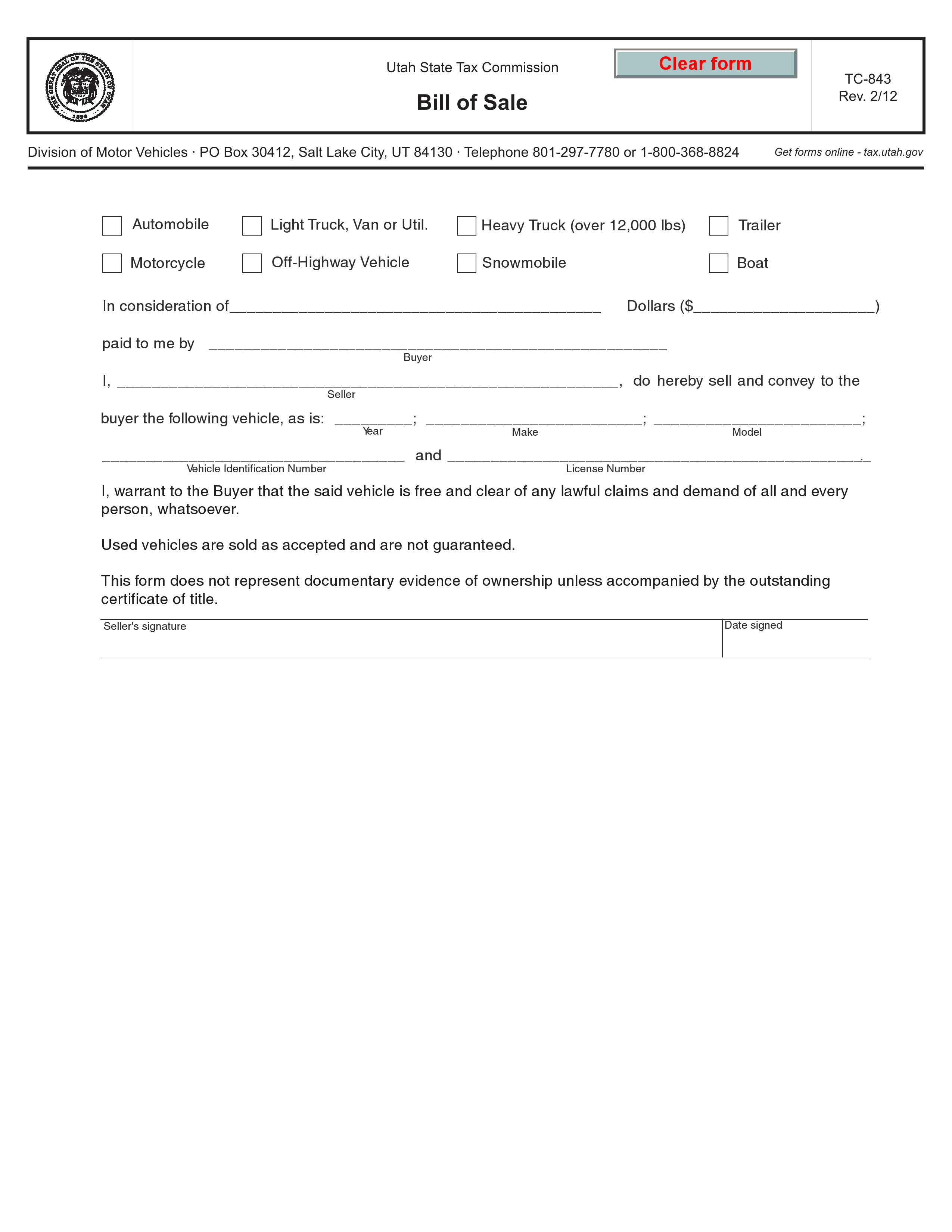

Free Utah Bill Of Sale Forms Pdf

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Utah car sales tax. There are a total of 206 local tax jurisdictions across the state collecting an average local tax of 205. However there are some services which are taxed for example services which include repairs renovations or installation laundry services or dry cleaning services. 801-297-2600 or toll-free 1-800-662-4335.

Find your state below to determine the total cost of your new car including the. If you get a proper bill of sale youll pay sales tax on the amount listed on it. Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134 801-297-2200 1-800-662-4335 taxutahgov Sales Tax Information for Vehicle.

As listed by the Sales Tax Handbook the state imposes a 685 percent sales tax rate on customers for purchasing a vehicle. You can also report curbstoners online at Utahs Motor Vehicle. Tax rates may change quarterly.

In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. If you suspect you are dealing with a curbstoner please contact the Motor Vehicle Enforcement Division at. Submitting a claim for refund does not guarantee the refund will be approved.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The state of Utah does not usually collect sales taxes on the vast majority of services performed. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

File electronically using Taxpayer Access Point at taputahgov. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335. Utah has a 485 statewide sales tax rate but also has 206 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 205 on top of the state tax.

If the vehicle is in use when the new registration period begins September 1st as an example the fees are not refundable. How Much Is the Utah Sales Tax on Cars. Taxutahgov If you need an accommodation under the Americans with Disabilities Act email taxadautahgov or call 801-297-3811 or TDD 801-297-2020.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. From the Utah DMV here. All dealerships may also charge a dealer documentation fee.

If the purchaser of the vehicle obtains a signed bill of sale from the seller of the vehicle the amount of sales andor use tax to be collected will be based upon the net purchase price shown on the bill of. Calculating Sales Tax Summary. Some dealerships may also charge a dealer documentation fee of 149 dollars.

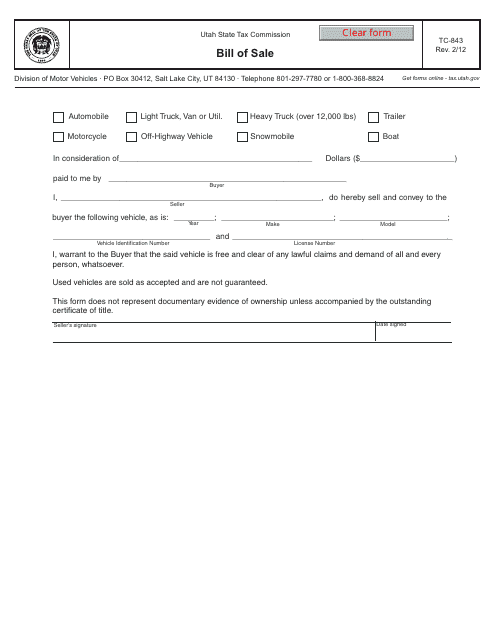

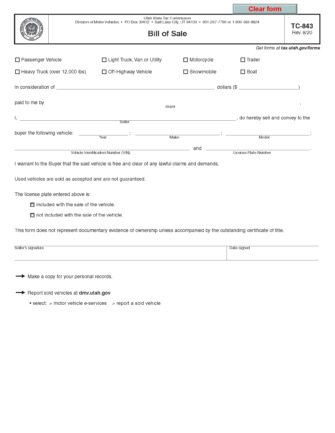

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. In addition to taxes car purchases in Utah may be subject to other fees like registration title and plate fees. Get forms at taxutahgovforms Utah State Tax Commission Division of Motor Vehicles PO Box 30412 Salt Lake City UT 84130 801-297-7780 or 1-800-368-8824 Bill of Sale Passenger Vehicle Light Truck Van or Utility Motorcycle Trailer Heavy Truck over 12000 lbs Off-Highway Vehicle.

This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Are services subject to sales tax in Utah. Please allow three working days for a response.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. The purchaser will pay the sales tax at the time the vehicle is titled and registered at the Utah Division of Motor Vehicles. In a private-party car sale a seller who is NOT a dealer is not required to collect sales tax on the transaction.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Utah collects a 685 state sales tax rate on the purchase of all vehicles. To request a refund of fees paid to the DMV visit Utahs Motor Vehicle Portal.

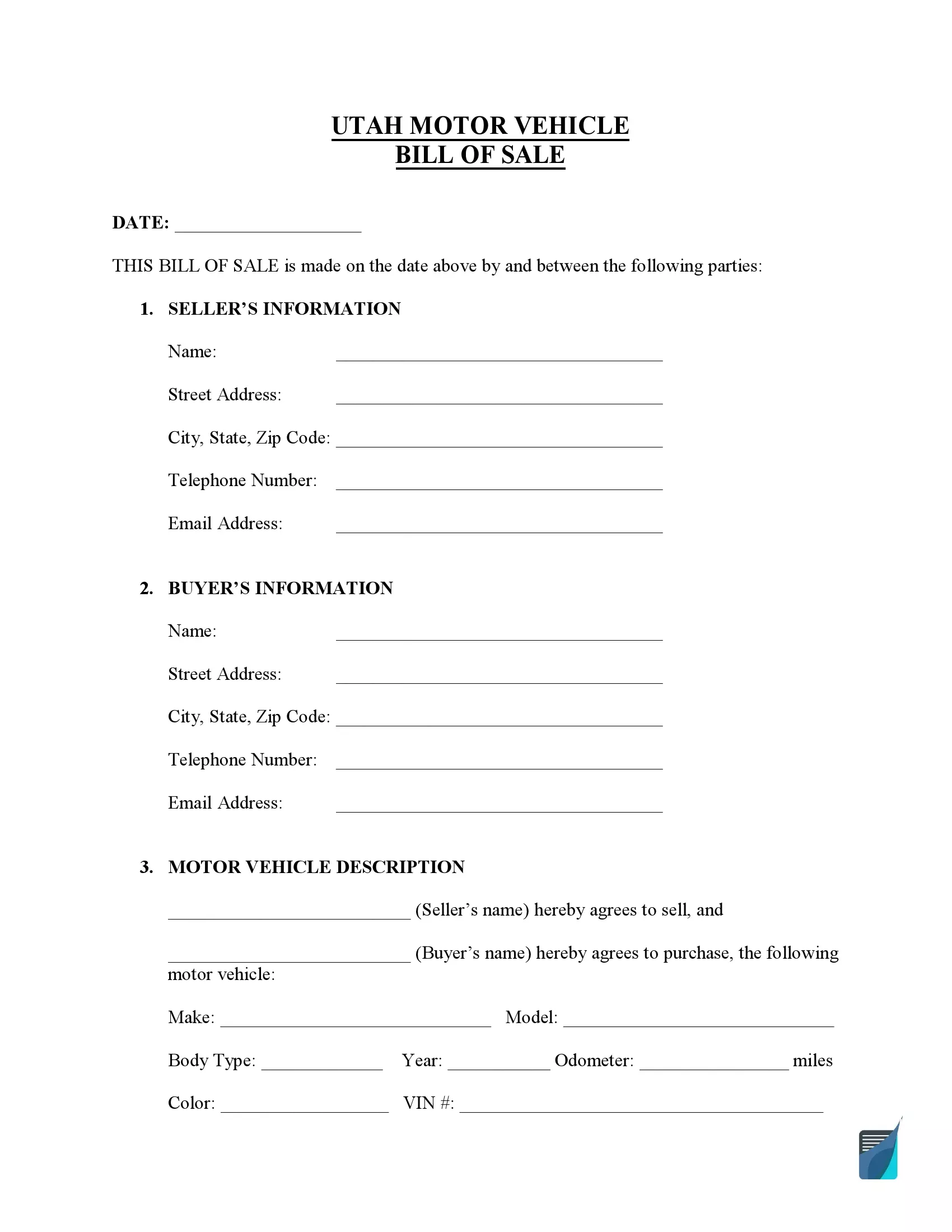

Free Utah Motor Vehicle Bill Of Sale Form Pdf 102kb 1 Page S

Free Utah Motor Vehicle Bill Of Sale Form Pdf Template Form Download

Utah Sales Tax On Cars Everything You Need To Know

Free Utah Bill Of Sale Tc 843 Pdf Word Do It Yourself Forms

Utah Bill Of Sale Automobile Trailer Boat Download Fillable Pdf Templateroller

Utah Bill Of Sale Filled Out Example Fill Online Printable Fillable Blank Pdffiller

Free Utah Motor Vehicle Bill Of Sale Form Pdf Word

Sales Tax On Cars And Vehicles In Utah

Free Utah Vehicle Bill Of Sale Form Pdf Formspal